Contents:

The Mimico Village BIA partners with local community organizations to organize the annual Tulip Festival every May, featuring music, entertainment, food, and family activities. The Midtown Yonge BIA is located on the Yonge subway line and will be a short walk from the Eglinton Crosstown LRT when the transit project is completed. The BIA is home to many retail, restaurant, food and personal services businesses, as well as dozens of medical professionals. Established in 1987, the BIA is made up of retail shops, service-providing businesses and restaurants.The BIA hosts the annual Long Branch Fest, a community event featuring food, live music, and children’s activities. The BIA is made up of retail stores, restaurants and cafes, bars, health and wellness providers, and a range of professional and other service-providing businesses – more than 150 businesses in total.

The area is one of the largest main street marketplaces of South Asian goods and services in North America, with shops that sell saris, fabrics and regional delicacies. Cultural holidays such as Vaisakhi, Eid and Diwali are also celebrated in the area. After payments are made a “Validation” is performed on a random sample of projects by the CanExport Program. Should you be selected for a validation, you will be required to submit “proof of costs incurred and paid” related to the submitted claim. This exercise validates that you are claiming eligible, accurate costs that are linked to your approved Target market.

Avoid technical terms but if they are necessary, explain them in a clear and concise manner. The BIA is made up of Korean restaurants, fashion boutiques, health and wellness providers , and various service-based businesses. The Toronto Financial District BIA is an economic development organization that represents businesses in Canada’s premier financial centre. There are more than 200,000 jobs in the Financial District, an area that includes Union Station, the PATH underground walkway and the country’s most prominent office towers.

- Ensure you regularly save your information as you progress through the online application process.

- For security reasons, your session will automatically time out after 2 hours of inactivity and unsaved work will not be saved.

- A major trade show in Germany will be held and customers from France will be attending.

- It is not possible to predict the overall impact of the introduction of the Exemption on disclosure or investor protection.

- The Toronto Financial District BIA is an economic development organization that represents businesses in Canada’s premier financial centre.

- It allows Forex and stock traders to automate trading through the use of trading robots, signals, and fundamental analysis.

Are put forward by fp marketses owned or led by groups that are traditionally underrepresented in international trade such as women, Indigenous Peoples, Black Canadians, LGBTQ2+, visible minorities and young entrepreneurs. In your application, verify that the total budget for your proposed activities is between $20,000 and $100,000. CanExport SMEs defines a project as the ensemble of activities for which a company requests funding in its application. Do not confuse it with a construction project or your company’s broader expansion plans.

View All Travel

Moreover, Canada has sanctions and related measures in place against a number of countries and sectors. A group of related companies can receive a maximum of $200,000 in funding per government fiscal year. “Related companies” includes but is not limited to parent company and subsidiaries, sister companies and affiliates. We calculate stacking based on the total funding provided by federal, provincial, territorial or municipal governments, or Crown corporations. The program does not reimburse expenses incurred prior to a project’s start date. The costs of the requested activities must be broken down by fiscal year in which the disbursements are to be made.

Natural Gas Price Forecast – Natural Gas Markets Continue Their Short-term Recovery – FX Empire

Natural Gas Price Forecast – Natural Gas Markets Continue Their Short-term Recovery.

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

To determine sales in a given market, CanExport SMEs considers brick-and-mortar retail sales as well as online sales. CanExport SMEs supports exploratory activities as well as activities that contribute toward a longer-term strategy for internationalization. Companies may opt for a multi-year project, or submit a new application to build upon a previous project. Including up to 5 international markets helps companies accelerate their growth and pursue a regional expansion strategy. The choice of 7 activity categories allows for a high degree of project customization.

However, as compared to a prospectus, the Exemption has lower standards of statutory liability and less gatekeeper involvement which may result in reduced incentives for issuers to ensure that their disclosure obligations have been met. Accordingly, while the amount of disclosure under the Exemption may be comparable to that required under a prospectus, the quality of the disclosure may be reduced and there may be a higher likelihood of a misrepresentation. The potential reduction in the quality of disclosure may also affect the investors purchasing in the secondary market, since the disclosure will be filed publicly. Item 13 of Part 5 of Form F requires the issuer to provide mandated disclosure about purchasers‘ rights under the listed issuer financing exemption. See subsection 3.12 for a description of these contractual rights and rights under secondary market liability in Canadian securities legislation.. In order for the CSA to measure and monitor the use of the Listed Issuer Financing Exemption, we propose that issuers would be required to file a report of exempt distribution within 10 days of the distribution date, as with most capital raising prospectus exemptions.

We expect all registrants to be aware of other CSA guidance on registrant obligations with respect to know-your-client, know-your-product and suitability, and identify and respond to conflicts of interest. If there has been a significant decline in working capital since the most recently audited annual financial statements, explain those changes. Using the following table, disclose the available funds after the offering. If you plan to combine additional sources of funding with the offering proceeds to achieve your principal purpose for raising capital, provide details about each additional source of funding.

FP Markets launches cTrader to compliment its existing market-leading offering

State the business objectives that you expect to accomplish using the available funds disclosed under item 8. Describe each significant event that must occur for the business objectives described to be accomplished and state the specific time period in which each event is expected to occur and the cost related to each event. • We will not close this offering unless we reasonably believe we have raised sufficient funds to meet our business objectives and all liquidity requirements for a period of 12 months. Established in 1985, the BIA is comprised of restaurants, cafes and bars, food vendors, gift and retail shops, and various service-providing businesses. The BIA organizes and runs The Taste of Little Italy, an annual community event featuring food and entertainment. The BIA is made up of retail stores and various service providers – more than 300 businesses in total.

In all cases, https://forex-reviews.org/ will not support fees to access these platforms or hosting fees. Marketing and advertising costs should be reasonable and support the objective of the project proposal. Expenses and activities incurred and/or paid before the project start date or after the project completion date are not eligible. Brazil, China, India and the United States are segmented into independent sub-national markets.

The distribution under the exemption and the subsequent resale may be considered in substance a single distribution. In order to comply with securities legislation, the subsequent purchasers should have the benefit of the issuer’s completed Form F and the rights provided under the exemption. Within 10 days of distributing securities under the listed issuer financing exemption, the issuer must file a report of exempt distribution in Form F1 Report of Exempt Distribution in every jurisdiction in which a distribution has been made. See section 5.1 of this Companion Policy for more information about filing a report of exempt distribution. If there is a misrepresentation in this offering document and you purchased securities from us under the listed issuer financing exemption, you have a contractual right to rescind your agreement to buy these securities.

1 Funding mechanism

Per diem expenses are paid to a maximum of 30 days per project, per person for a maximum of 2 travelers per trip. For each trip planned, indicate the number of travelers and the number of days they expect to travel or conduct business. NRC IRAP requires 30 business days to process final claims and report before a new application can be submitted to the program. The program funds up to 50% of eligible costs for $10,000 to $50,000 in funding per project.

The Listed Issuer Financing Exemption recognizes the comprehensive continuous disclosure regime for reporting issuers, supported by certification requirements and secondary market liability, and the fact that any investor can acquire securities of a reporting issuer on the secondary market. The MiG Report data for 2020 illustrates that smaller issuers are much less likely to use prospectuses than larger issuers. In 2020, TSX Venture Exchange-listed reporting issuers raised $1.9 billion by way of prospectus as compared to $4.5 billion by way of private placement. In contrast, Toronto Stock Exchange-listed reporting issuers raised $19.4 billion by way of prospectus as compared to only $10 billion by way of private placement. Data from FP Advisor also suggests that most short form prospectuses are filed to raise greater than $10 million. Due to the broader accessibility to retail investors, retail investors may be able to access investments in reporting issuers that were previously unavailable to them.

S&P 500 Forecast: Index Continues to Be Very Choppy – DailyForex.com

S&P 500 Forecast: Index Continues to Be Very Choppy.

Posted: Wed, 01 Mar 2023 08:00:00 GMT [source]

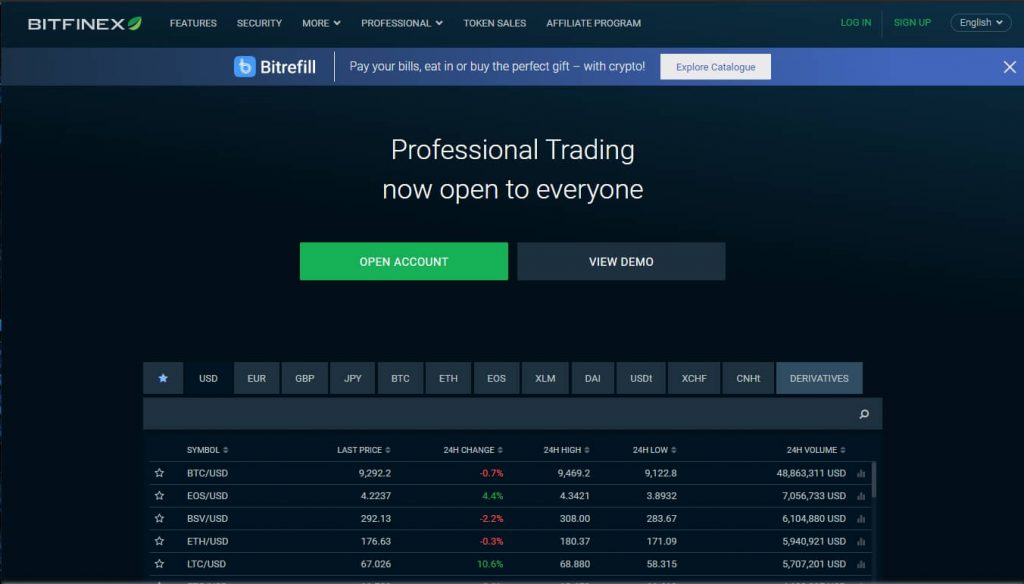

FXCM is a retail foreign exchange broker that allows customers to trade on the currency market. This broker enables people to speculate on the foreign exchange market and offers CFD trading on major indices and commodities such as gold and crude oil. FP Markets shines as a low-cost broker for trading Forex and CFDs as long as you utilize the MetaTrader platform. The Iress platform suite has over 10,000 tradeable symbols, but it is primarily a share trading platform – and is, therefore, a much more expensive option. The mission of IC Markets is to provide the best and most transparent trading experience for retail and institutional clients.

The risks to retail investors that participate in an offering under the Exemption are mitigated by the offering limits, the disclosure in the offering document and the secondary market and contractual liability provisions. An issuer’s continuous disclosure record is considered sufficient to support informed trading of listed securities on a Canadian stock exchange. The Exemption is primarily limited to offering securities of the same class that trade on a recognised exchange in Canada. The disclosure available to purchasers under the Exemption is more comprehensive than the disclosure available to investors trading in the secondary market. This is because the Exemption includes supplementary disclosure requirements which are intended to address that fact that investors are purchasing from the issuer of the securities, rather than a third party with no informational advantage regarding the securities.

Once funds for the fiscal year are fully allocated, applications will no longer be accepted. Additionally, funding is not available for projects focusing on tobacco, vaping or any similar industries involvingrecreational substance inhalation. Over the span of one year, these employees represent the equivalent of 1 full-time employee. CanExport SMEs reserves the right to deny travel funding requests for any reason, at our sole and absolute discretion.

The primary benefits to reporting issuers of using the Exemption as opposed to other commonly used prospectus exemptions, such as the AI or FFBA exemptions, is the ability to offer securities to any purchaser without resale restrictions. These benefits may be somewhat offset due to the higher disclosure standards under the Exemption. In addition, purchasers that purchase with an intention to immediately resell the securities in the secondary market should consider the definition of underwriter in securities legislation and whether they are required to be registered. Section 1.7 of this Companion Policy provides guidance on the expectations on underwriters when purchasing securities under prospectus exemptions with a view to immediately resell those securities. There is no requirement to have a minimum offering amount under the listed issuer financing exemption.

As noted above, the fact that securities distributed under the Exemption would be freely tradeable may lead to an increase in short-term market volatility due to an increase in short-term investor participation in offerings. The Exemption requires issuers to supplement their continuous disclosure with a short offering document to disclose any new developments in the issuer’s business, the expected use of proceeds from the offering and any material facts not already disclosed in the issuers‘ filings over the last year . Preparing this offering document will involve consideration of all material facts related to the issuer and its securities and will involve disclosure that is comparable to that required under a prospectus. Item 9 of Part 3 of Form F requires the issuer to disclose how it will use the available funds identified in item 8.

The listed issuer financing exemption does not require the purchaser to have purchased the securities through a dealer. The exemption is an exemption from the prospectus requirement only; it does not provide an exemption from the dealer registration requirement. The CSA has heard from many stakeholders that the time and cost to prepare a short form prospectus may be an impediment to capital raising, particularly for smaller issuers. /PRNewswire/ –FP Marketshas increased its suite of trading platforms in another move to meet the evolving needs of its traders and investors, providing its clients with a range of choices to suit trading styles and preferences, and giving them the professional tools they need to succeed. CTraderis an all-in-one trading experience that caters to short-term traders and longer-term position investors seeking access to multiple asset classes, including Forex, Stocks, Commodities, Indices, ETFs, Bondsand Digital Currencies.